A Stocks and Shares ISA is a tax-efficient investment account that allows you to invest in a range of assets, such as stocks, bonds, funds, and ETFs, without paying tax on dividends, capital gains, or income. Here’s a detailed guide to help you understand and get started with a Stocks and Shares ISA.

1. Benefits of a Stocks and Shares ISA

- Tax-Free Growth: No Capital Gains Tax (CGT) on profits.

- Tax-Free Income: Dividends and interest earned are tax-free.

- Flexibility: Invest in a wide range of assets, including individual shares, ETFs, and mutual funds.

- Long-Term Growth: Historically, equities tend to outperform cash savings over time.

- Inheritance Benefits: Your spouse or civil partner can inherit ISA benefits after your death.

2. How It Works

- Annual Allowance: The maximum you can contribute to all your ISAs combined is £20,000 per tax year (2023/24).

- Investments: You can invest in:

- Individual company stocks.

- Exchange-Traded Funds (ETFs).

- Mutual funds or index funds.

- Bonds (corporate and government).

- Investment trusts.

- Providers: Stocks and Shares ISAs are offered by banks, brokers, and investment platforms.

- Fees: Typically, you’ll pay platform fees, fund management fees, and possibly trading fees.

3. Is It Right for You?

A Stocks and Shares ISA may suit you if:

- You want to invest for the medium to long term (at least 5 years).

- You’re comfortable taking some risk with your capital for potentially higher returns.

- You’ve already built an emergency fund (to avoid needing to sell investments in a downturn).

4. Key Features to Compare

When selecting a provider, consider the following:

- Platform Fees:

- Percentage-based (e.g., Vanguard: 0.15%) vs flat fees (e.g., Interactive Investor: £9.99/month).

- Investment Options:

- Range of funds, ETFs, and individual stocks.

- Specialist options like sustainable or thematic funds.

- Ease of Use:

- Beginner-friendly platforms vs advanced tools for experienced investors.

- Trading Costs:

- Some platforms charge per trade (e.g., AJ Bell), while others offer commission-free trades (e.g., Trading 212).

- Customer Support:

- Availability of guidance and advice.

- Flexibility:

- Some ISAs allow flexible withdrawals and re-contributions.

5. Best Stocks and Shares ISA Providers

Here’s a comparison of popular providers:

Vanguard

- Best for: Low-cost index investing.

- Fees: 0.15% annual fee + fund fees (~0.1%-0.2%).

- Investment Range: Vanguard funds and ETFs.

- Minimum Investment: £500 lump sum or £100/month.

- Ease of Use: Great for beginners.

Hargreaves Lansdown

- Best for: Wide investment choices and research tools.

- Fees: 0.45% annual fee (on portfolios up to £250,000) + trading fees.

- Investment Range: Extensive, including stocks, ETFs, funds, and investment trusts.

- Minimum Investment: £100 lump sum or £25/month.

AJ Bell Youinvest

- Best for: Cost-conscious investors seeking a broad range.

- Fees: 0.25% annual fee + trading fees (£1.50 for funds, £9.95 for shares).

- Investment Range: Stocks, ETFs, funds, and bonds.

- Minimum Investment: £25/month.

Trading 212

- Best for: Commission-free investing.

- Fees: Free ISA account, but some ETFs may have indirect charges.

- Investment Range: Stocks, ETFs, and fractional shares.

- Ease of Use: Mobile-first design.

Interactive Investor (ii)

- Best for: Larger portfolios with flat fees.

- Fees: £9.99/month flat fee (includes one free trade).

- Investment Range: Extensive options, including global stocks and funds.

- Ease of Use: Advanced tools for experienced investors.

6. Example Investment Portfolio

Here’s how you might allocate investments in a Stocks and Shares ISA:

Balanced Portfolio (Medium Risk, Long-Term Growth)

| Asset Class | Allocation (%) | Example Investments |

|---|---|---|

| Global Equities | 50% | Vanguard FTSE All-World ETF (VWRL). |

| U.S. Equities | 20% | iShares S&P 500 ETF (IUSA). |

| Emerging Markets | 10% | iShares MSCI Emerging Markets ETF (EMIM). |

| Bonds | 15% | iShares Core Global Aggregate Bond ETF (AGGH). |

| Real Estate/REITs | 5% | Vanguard Global REIT ETF (VNQ). |

Growth Portfolio (Higher Risk, Higher Potential Returns)

| Asset Class | Allocation (%) | Example Investments |

|---|---|---|

| Tech & Innovation | 30% | ARK Innovation ETF (ARKK), Nvidia (NVDA). |

| Global Equities | 30% | Vanguard FTSE All-World ETF (VWRL). |

| Emerging Markets | 20% | iShares MSCI Emerging Markets ETF (EMIM). |

| Sustainable Funds | 10% | iShares Clean Energy ETF (ICLN). |

| Crypto | 10% | Bitcoin (BTC), Ethereum (ETH) (if allowed). |

7. Steps to Open a Stocks and Shares ISA

- Choose a Provider: Based on your investment goals, fees, and ease of use.

- Open an Account:

- Provide personal details and your National Insurance Number.

- Fund Your ISA:

- Deposit a lump sum or set up regular contributions.

- Select Investments:

- Build your portfolio with ETFs, funds, or individual stocks.

- Monitor and Adjust:

- Rebalance periodically to maintain your desired asset allocation.

8. Key Rules

- One Provider Per Year:

- You can only open and contribute to one Stocks and Shares ISA per tax year.

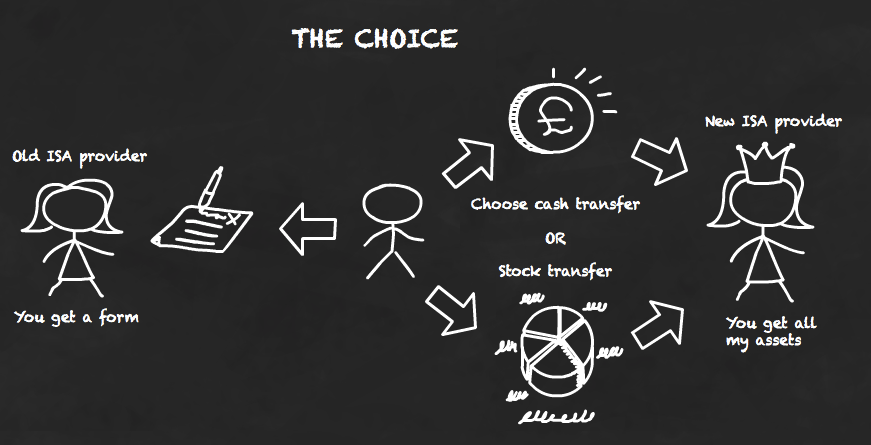

- Transfers:

- You can transfer ISAs between providers to get better fees or options.

- No Loss of Allowance:

- ISA transfers don’t count as withdrawals, so your tax benefits are preserved.

Would you like help?

- Designing a personalized ISA portfolio?

- Understanding how to transfer existing investments into a Stocks and Shares ISA?