Africa’s Fintech & Digital Payments: Beyond Mobile Money in 2026

Africa’s fintech and digital payments landscape has evolved dramatically beyond its mobile money roots. While pioneers like M-Pesa continue to drive inclusion—with transaction values exceeding hundreds of billions annually—the sector is maturing into a sophisticated ecosystem focused on interoperability, embedded finance, cross-border integration, and real-time infrastructure. Africa’s digital payments market is on track to surpass $40 billion by the end of 2026, powered by a young, mobile-first population, rapid e-commerce growth, and strategic partnerships that build resilient rails for the continent’s digital economy.

This shift reflects a move from basic P2P transfers to comprehensive financial plumbing: open banking APIs, stablecoin-enabled settlements, and seamless integrations that embed payments into everyday platforms like e-commerce, logistics, and agriculture.

Key Trends Defining 2026: Moving Up the Value Chain

Africa’s fintech is prioritizing depth over breadth, with consolidation, profitability, and infrastructure playing central roles.

- Interoperability and Real-Time Payments: National switches like Nigeria’s NIP, Kenya’s PesaLink, and regional systems like PAPSS enable instant A2A transfers across banks, wallets, and borders. Real-time rails now fuel innovations in QR codes, merchant payments, and low-cost remittances, reducing fragmentation and costs.

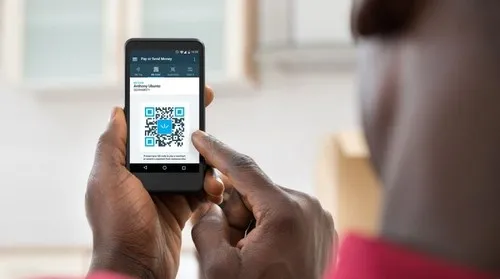

These vibrant scenes capture everyday Africans embracing QR code and digital payments in markets and urban settings:

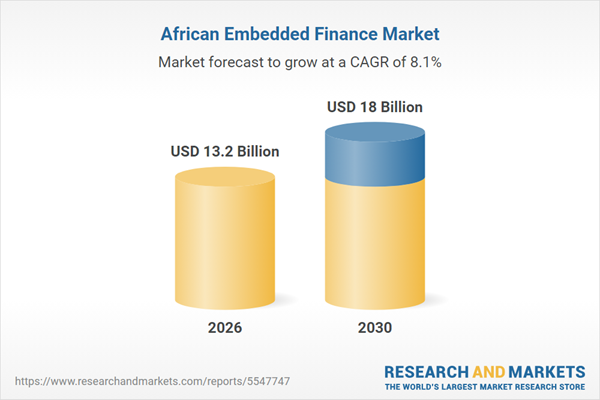

- Embedded Finance and Super Apps: Payments, lending, and insurance are now woven into non-financial platforms—e-commerce checkouts, ride-hailing, and supply chains. Winners combine rails with partnerships to plug into merchants, banks, and mobile money, creating seamless experiences.

Illustrating embedded finance in action, these images show integrated digital wallets and checkout flows transforming commerce:

- Cross-Border and Stablecoin Momentum: Initiatives like PAPSS and fintechs leveraging stablecoins for cheaper, faster settlements are accelerating “Africa-to-Africa” and global flows. Stablecoins move from speculation to infrastructure for remittances, B2B payouts, and treasury management.

These futuristic visuals represent the cross-border connectivity reshaping Africa’s payments landscape:

- Open Banking and Infrastructure Plays: Acquisitions like Flutterwave’s purchase of Mono highlight the push for open banking APIs that enable data access, direct payments, and identity verification—building trust and interoperability.

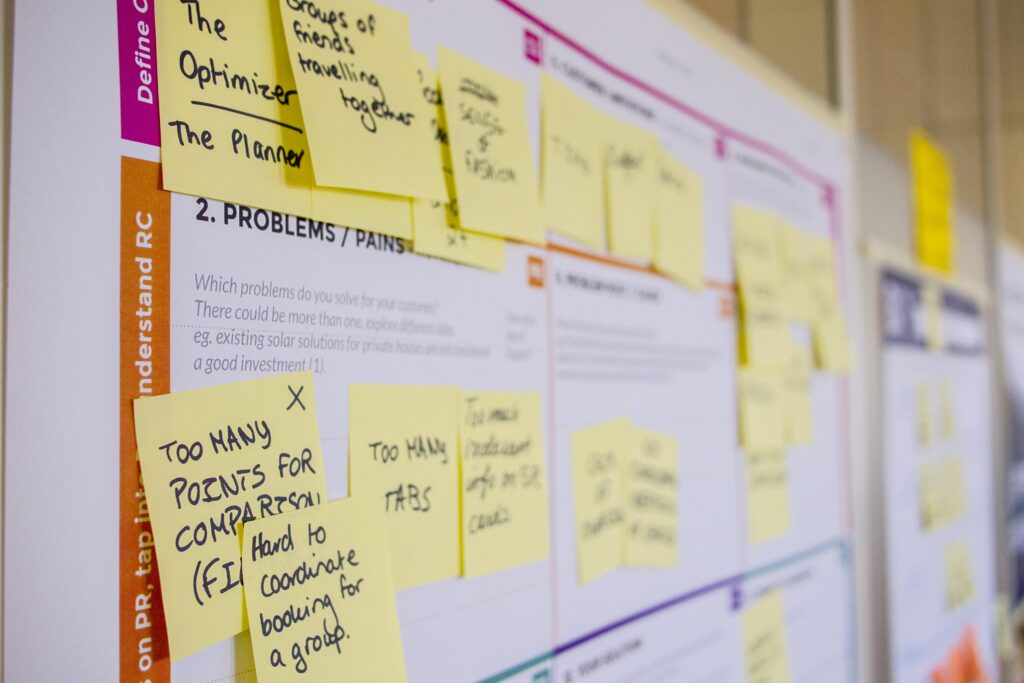

Modern fintech hubs buzz with teams developing the next generation of open and embedded solutions:

Major Developments and Players in 2026

- Flutterwave integrates open banking via Mono acquisition, targeting treasury tools and pan-African expansion.

- Global entrants like PayPal plan cross-border wallet launches, partnering with local players for seamless access.

- Stablecoin adoption grows in regulated markets (Kenya, Ghana, Nigeria, South Africa), powering B2B and remittances.

- Regulatory progress includes passporting (Ghana-Rwanda) and open banking frameworks, fostering collaboration.

Challenges and Outlook

Fragmented regulations, FX volatility, and the need for harmonized KYC/AML persist, but momentum favors resilient models. In 2026, Africa’s fintech isn’t just expanding inclusion—it’s constructing the foundational infrastructure for a connected, profitable digital economy. With embedded finance projected to reach billions and cross-border flows accelerating under AfCFTA, the continent is exporting solutions globally while powering sustainable growth at home. The era beyond mobile money is here: faster, smarter, and truly interconnected