Agribusiness & Food Security: Profitable Opportunities in Africa’s $1 Trillion Sector by 2030

Africa’s agribusiness and food systems stand on the cusp of explosive growth, with projections from the African Development Bank (AfDB) and World Bank indicating the sector could reach $1 trillion by 2030—tripling from current levels through value addition, technology adoption, and regional integration. This transformation addresses pressing food security challenges for a population expected to double by 2050, while creating massive profitable opportunities in sustainable production, processing, and digital innovation. Smallholder farmers, who produce up to 70% of the continent’s food, remain central, but smart investments in infrastructure, climate-resilient practices, and markets can unlock inclusive growth and reduce import dependency.

The $1 Trillion Opportunity: Drivers and Projections

Africa’s vast arable land (60% of the world’s uncultivated potential), youthful population, and frameworks like the Comprehensive Africa Agriculture Development Programme (CAADP) 2026-2035 and AfCFTA are fueling momentum. The sector could generate millions of jobs, boost exports, and enhance food security by focusing on high-value chains, reducing post-harvest losses (up to 37% in some areas), and embracing digital tools.

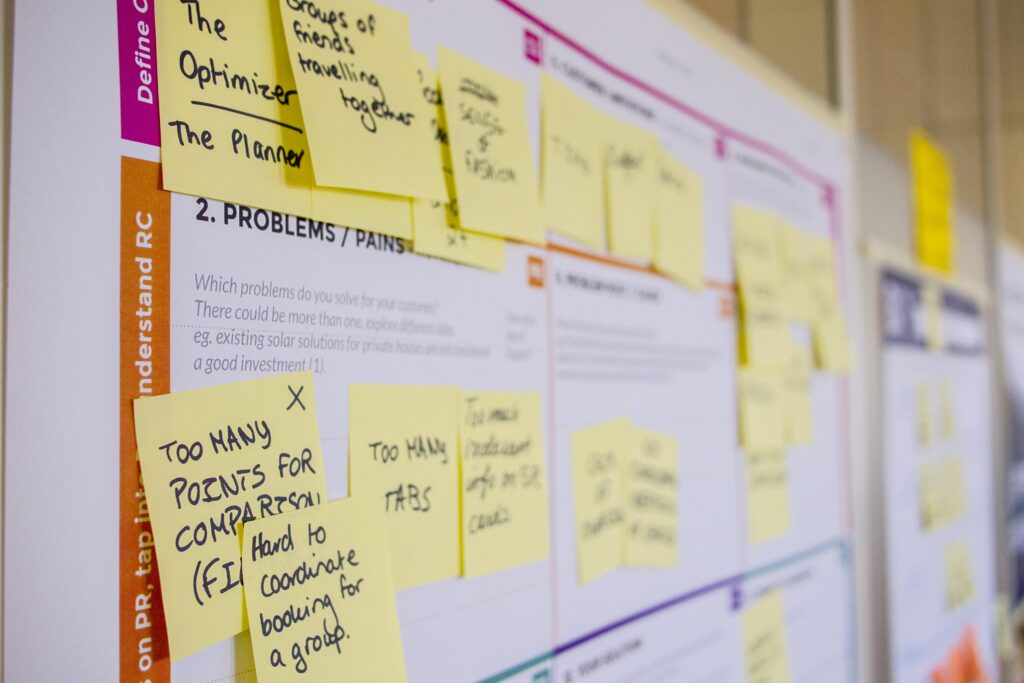

These images showcase modern, tech-enabled farming transforming Africa’s agricultural landscape:

Key Profitable Opportunities in 2026 and Beyond

Investors and entrepreneurs are targeting high-ROI areas with strong demand, low entry barriers in some cases, and alignment with sustainability goals:

- Agro-Processing and Value Addition: Processing raw commodities into finished goods (e.g., canned fruits, milled grains, oils) captures higher margins and reduces waste. Cold chain logistics and packaging are booming, with sectors like palm oil, cassava, and horticulture offering strong returns.

- Precision and Digital Agriculture (Agritech): Platforms providing data-driven insights, market access, and inputs via apps connect farmers to buyers, boosting yields and incomes. Youth-led startups in drone monitoring, AI advisory, and traceability are scaling rapidly.

These visuals highlight how digital tools empower farmers from field to market:

- Sustainable and Climate-Resilient Farming: Solar-powered irrigation, drought-resistant crops, organic cooperatives, and precision techniques enhance resilience amid climate risks. Opportunities in regenerative practices and carbon credits are emerging.

- Specialty Crops and Livestock: High-demand areas like oil palm, habanero peppers, beekeeping, and insect-based feed (e.g., via startups like NovFeed) deliver quick turnovers and export potential.

- Equipment Leasing, Consulting, and Farm Services: Mechanization, consulting, and transport services support smallholders scaling up profitably.

These scenes illustrate sustainable, high-value processing and greenhouse innovations driving profitability:

Initiatives and Investments Fueling Growth

Flagship efforts like the AfDB’s Special Agro-Industrial Processing Zones (SAPZ), blended finance platforms, and CAADP’s $100 billion mobilization target aim to de-risk investments and build resilient value chains. Public-private partnerships, youth training, and regional trade under AfCFTA are accelerating progress.

Challenges and the Path Forward

Hurdles include infrastructure gaps, climate risks, access to finance, and post-harvest losses. Success requires ethical land practices, inclusive models (especially for women and youth), and blended capital to bridge funding shortfalls.

In 2026, Africa’s agribusiness isn’t just about survival—it’s a high-impact, high-return engine for food security, economic diversification, and global leadership. With strategic focus on technology, processing, and sustainability, the continent is poised to feed itself and the world profitably by 2030.