Funding the Future: How Venture Capital is Evolving for African Entrepreneurs in 2026

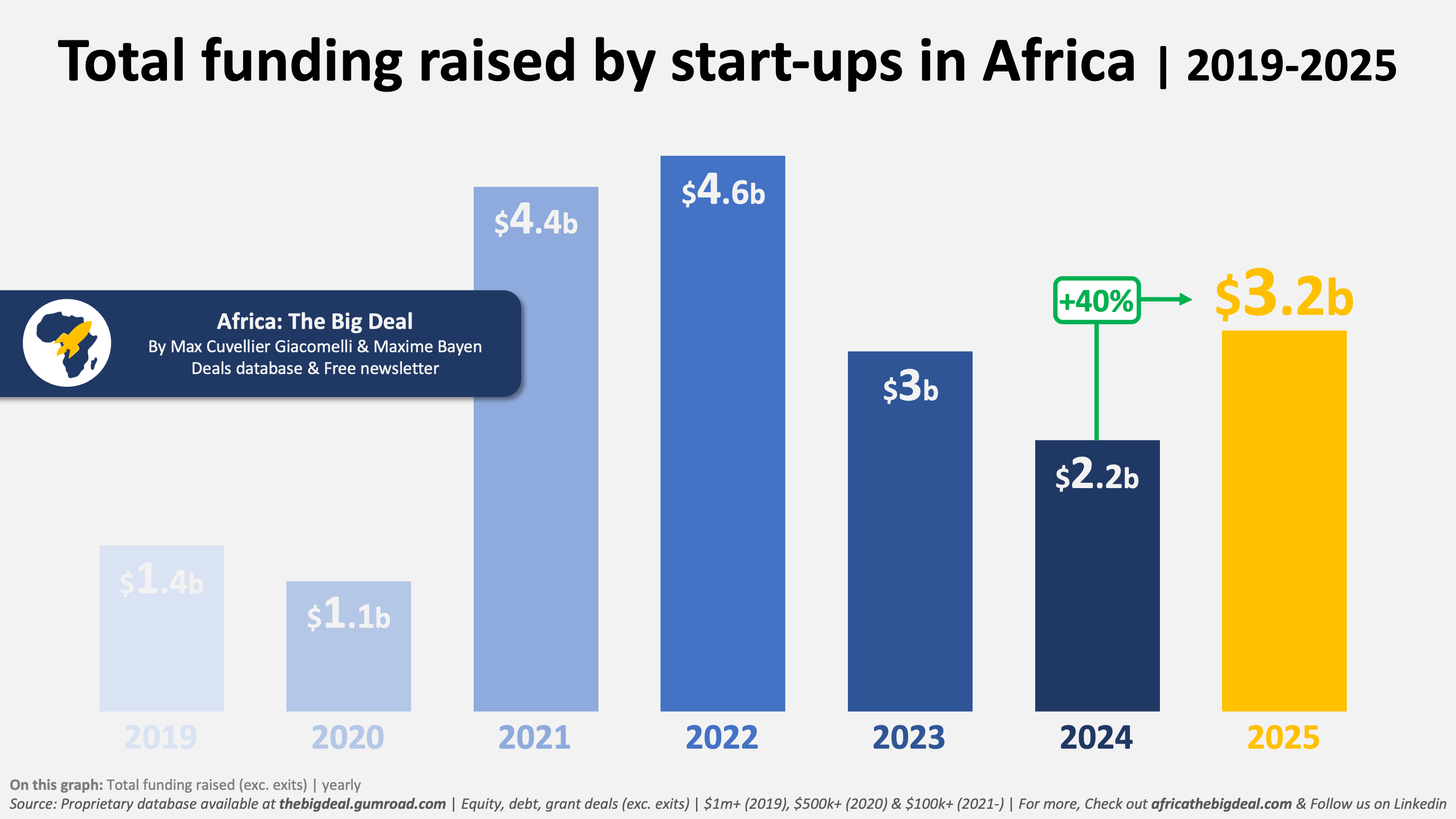

Africa’s startup ecosystem has solidified its rebound from the 2023-2024 funding winter. In 2025, African startups raised approximately $3.1–$3.2 billion—a 40-41% increase from 2024’s $2.2 billion—marking the strongest performance since the post-pandemic highs and surpassing 2023 levels. This recovery signals renewed investor confidence, but it’s far from a return to the “growth-at-all-costs” era. Venture capital (VC) has evolved into a more mature, selective landscape: disciplined, profitability-focused, and increasingly anchored by local and alternative capital sources.

The shift emphasizes utility-first investments in foundational infrastructure—payments rails, clean energy, mobility, AI-enabled tools, and B2B services—while prioritizing unit economics, governance, and sustainable models over hype-driven valuations.

Key Evolutions in VC for African Entrepreneurs

Several structural changes define 2026’s funding environment:

- Selective and Bottom-Heavy Recovery: Deal volumes rebounded strongly, especially at seed and early stages, but late-stage activity remains limited with fewer, larger rounds. Investors demand clear paths to profitability, recurring revenue, and FX resilience amid currency volatility.

- Rise of Venture Debt and Non-Dilutive Capital: Debt financing surged, often exceeding $1 billion annually and comprising up to 45% of total funding in asset-backed sectors like energy and logistics. This less-dilutive option appeals to founders seeking growth without heavy equity dilution.

- Increasing Role of Intra-African and Local Capital: Local investors now contribute roughly one-third of deals, providing stability against global pullbacks. African acquirers, corporates, banks, and telcos drive more exits via M&A, fostering a self-reliant ecosystem under AfCFTA.

- Sector Realignment: Clean energy overtook fintech as a top-funded sector in parts of 2025, with projected 20-30% YoY growth in climate, mobility, and energy. Fintech evolves toward embedded finance, RegTech, and infrastructure, while AI/deep tech emerges rapidly.

These images illustrate the modern pitch environments where African entrepreneurs connect with selective investors in 2026:

Funding charts from 2025 highlight the rebound’s scale and concentration:

Geographic and Sector Shifts

The “Big Four” (Kenya, South Africa, Egypt, Nigeria) still dominate, but with twists—Kenya surged to lead in 2025, driven by clean energy, while Nigeria slipped due to macroeconomic challenges. Geographic broadening continues modestly, with emerging hubs gaining traction.

These vibrant African tech hubs continue to foster connections between entrepreneurs and evolving VC players:

Challenges and Opportunities Ahead

Despite the rebound, hurdles persist: limited late-stage capital, unicorn drought (no new official unicorns in 2025), and FX risks. Yet opportunities abound for entrepreneurs with proven traction—patient capital favors impact-driven, infrastructure-focused models.

In 2026, success hinges on building resilient, profitable businesses aligned with Africa’s real-economy needs. VC isn’t just returning—it’s maturing into a force for sustainable, inclusive growth, empowering African founders to lead the continent’s next chapter