From Raw Materials to Production Sovereignty: Africa’s Shift in 2026

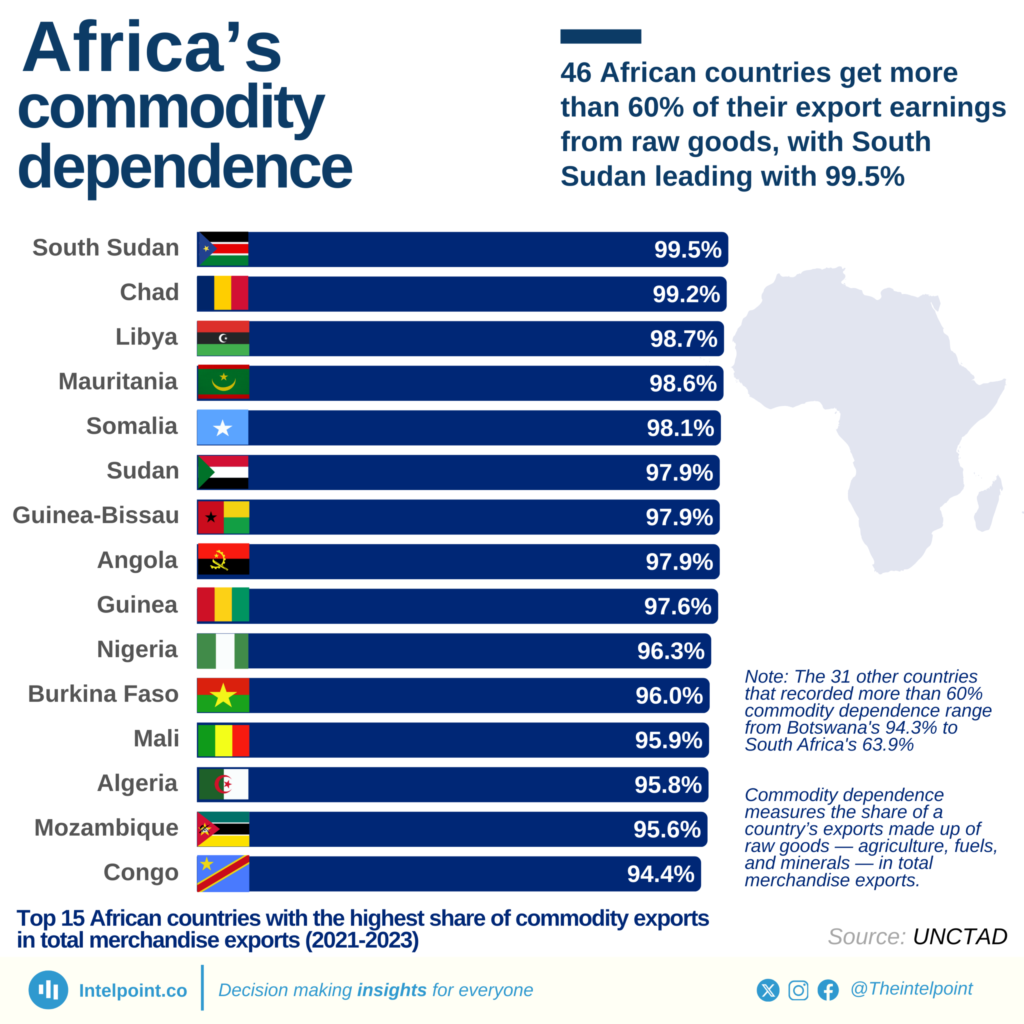

In 2026, Africa stands at a pivotal inflection point in its economic trajectory. For centuries, the continent has been positioned primarily as a supplier of raw materials—exporting unprocessed minerals, agricultural commodities, and other resources while importing finished goods. This model has perpetuated dependency, limited job creation, and exported much of the economic value abroad. However, a profound shift is underway: African nations are increasingly pursuing production sovereignty, emphasizing local processing, value addition (beneficiation), and integrated industrial development. This transformation is driven by global demand for critical minerals essential to the green energy transition, declining traditional aid flows, and a renewed policy focus on self-reliance and continental integration.

The Drivers of Change

Several converging factors are fueling this momentum in 2026:

- Global Demand for Critical (Green) Minerals: Africa holds approximately 30% of the world’s reserves of minerals vital for batteries, electric vehicles (EVs), renewable energy systems, and digital technologies—including over 50% of cobalt, significant shares of lithium, manganese, graphite, and platinum group metals. Surging demand from the energy transition has created leverage for African countries to demand more than extraction.

- Policy Bans and Restrictions on Raw Exports: Over a dozen countries have imposed or strengthened bans on exporting unprocessed minerals since 2022. Examples include Zimbabwe and Namibia’s restrictions on raw lithium, cobalt, and other critical minerals; the DRC’s royalty increases and quotas; and similar moves in Ghana and Nigeria. These policies aim to force local processing and capture higher value.

- Continental Frameworks and Cooperation: The African Union’s African Green Minerals Strategy (AGMS), adopted in early 2025, provides a unified blueprint for beneficiation, responsible mining, and green industrialization. It aligns with the African Mining Vision (2009) and the African Continental Free Trade Area (AfCFTA), promoting regional value chains, shared infrastructure, and collective bargaining to avoid fragmented approaches.

- Decline of Aid and Rise of Assertive Diplomacy: With reduced reliance on traditional aid (e.g., the “demise of USAID” and broader shifts), policymakers are adopting an offensive stance. Initiatives like the “Accra reset” emphasize partnerships that build sovereign production capabilities rather than compliance-based aid.

Key Developments and Examples in 2026

Across the continent, concrete projects and investments illustrate the shift:

- Battery and EV Value Chains: The DRC and Zambia continue advancing cross-border initiatives for nickel-manganese-cobalt (NMC) battery precursors, supported by partnerships like those with the African Development Bank. New processing facilities are coming online, with Zambia commissioning significant cobalt sulfate refineries and the DRC expanding copper-cobalt output.

- Lithium Processing Hubs: Zimbabwe’s Huayou Cobalt plant is set to produce over 50,000 tons of battery-grade lithium sulphate annually starting early 2026. Nigeria is accelerating plans for large-scale rare earth and lithium facilities, targeting 30% local processing and raising mining’s GDP contribution.

- Regional and National Strategies: Morocco is emerging as a North African battery hub with gigafactories and cathode material plants operational or starting in 2026. Namibia’s export bans on unprocessed critical minerals incentivize domestic beneficiation, while South Africa’s Critical Minerals Strategy focuses on value addition for economic security.

Here are visuals highlighting key processing and mining advancements driving this shift:

These images depict active mining sites and emerging processing facilities in key African regions, symbolizing the move from extraction to value-added production.

Challenges Ahead

Despite progress, hurdles remain:

- Infrastructure gaps (e.g., reliable energy, logistics).

- Skills shortages and high capital costs.

- Geopolitical competition (e.g., from China, EU, US) that could limit technology transfer.

- Ensuring equitable benefits, environmental protection, and community involvement to avoid repeating past exploitation patterns.

Outlook for the Future

In 2026, Africa’s push for production sovereignty is no longer aspirational—it’s manifesting through policies, investments, and regional collaboration. By prioritizing local beneficiation and green industrialization, the continent can transform its mineral wealth into engines of job creation, economic diversification, and sustainable growth. This shift positions Africa not as a passive supplier but as a central player in the global green transition, potentially rewriting the rules of development for generations to come.