Preparing a Good Business Plan: Five Basic Steps

Creating a strong business plan is essential for starting a new venture, securing funding, guiding growth, or simply clarifying your strategy. While full business plans can include 8–15 sections, many reliable sources (including the U.S. Small Business Administration and experienced advisors) boil the preparation process down to five fundamental steps that form the core workflow.

Here are five basic steps to prepare a good business plan:

- Define Your Vision, Concept, and Goals Start by clearly articulating what your business is, why it exists, and where you want it to go.

- Write a concise mission statement (your purpose).

- Describe your products/services, target customers, and unique value proposition.

- Set realistic short-term (1–2 years) and long-term (3–5+ years) goals. This step lays the foundation—everything else builds on it. Many experts recommend doing initial market validation here (talk to potential customers, check competitors) to refine your idea before investing more time.

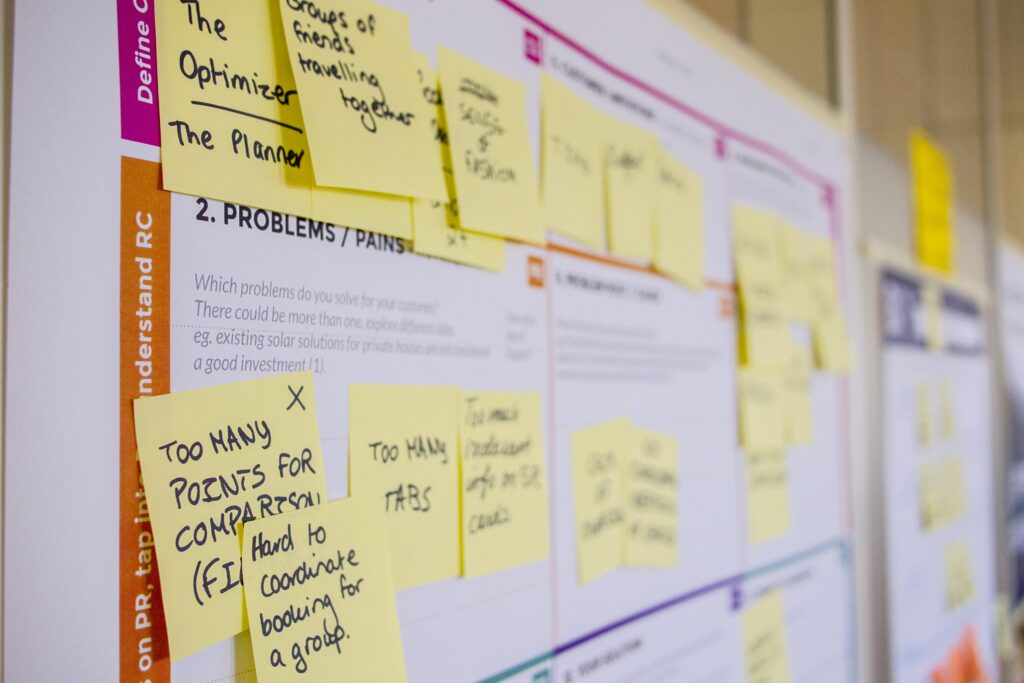

- Conduct Market Research and Analysis Gather evidence that shows demand and opportunity.

- Identify your target market (demographics, size, needs, buying behavior).

- Analyze competitors (their strengths/weaknesses, market share, pricing).

- Assess industry trends, barriers to entry, and economic factors. This step proves your business fills a real gap and can succeed. Use free resources like government data, industry reports, surveys, or customer interviews. A weak market analysis is one of the most common reasons plans fail to convince investors.

- Develop Your Strategy and Operational Plan Explain how you will win customers and run the business day-to-day.

- Outline your marketing and sales strategy (channels, pricing, promotion, customer acquisition).

- Describe operations (location, suppliers, production/delivery process, technology/tools needed).

- Detail your team/organizational structure (who does what, key roles, any gaps). Focus on realistic, actionable steps with timelines. This shows you’ve thought through execution, not just the idea.

- Create Realistic Financial Projections and Requirements Numbers turn your story into something credible.

- Estimate startup costs, ongoing expenses, and revenue forecasts (at least 3–5 years).

- Prepare basic statements: projected income (profit & loss), cash flow, and balance sheet.

- Calculate break-even point and key metrics (e.g., customer acquisition cost, gross margin).

- If seeking funding, clearly state how much you need, what it will be used for, and potential return/exit for investors. Be conservative—overly optimistic numbers hurt credibility. Use tools like spreadsheets or free SBA/Score templates.

- Write, Refine, and Summarize the Plan Pull everything together into a clear, professional document.

- Start with an executive summary (1–2 pages) — write this last, as it overviews the entire plan (your hook for readers).

- Organize the full plan logically (company description → market analysis → strategy → operations → financials → appendix).

- Keep it concise yet comprehensive (typically 15–30 pages for traditional plans; shorter for lean versions).

- Proofread carefully, get feedback (from mentors, accountants, or peers), and revise. Treat it as a living document—update it as your business evolves.

A good business plan isn’t just paperwork—it’s a thinking tool that forces clarity and reveals gaps early. If you’re preparing one for funding (bank loan, investors), emphasize evidence, realistic projections, and risk awareness. For internal use, focus more on actionable steps and milestones.

Would you like a simple template outline, examples for a specific industry, or help with any particular section (e.g., financials or market analysis)?